Financial innovation has now become a part of our daily life. The first mobile phone appeared less than 50 years ago and weighed over 2 lbs. It was already magic that it allowed calling. Could anyone imagine that we would be able to pay for purchases using phones in less than 25 years? Nobody has known about cryptocurrency 15 years ago. Now its value is estimated at billions of dollars.

Financial technology has influenced banking, insurance, investment, commerce, business and has helped many companies to operate more efficiently.

What is Fintech?

Financial technology means implementing innovations to traditional systems and services using applications, software, business models. It helps to simplify and expand existing processes in finance.

Fintech has become popular since 2008 due to the consequences of the global financial crisis. It has forced companies to look for ways of reducing costs. At the same time, the influence of mobile technologies has grown. People started to use more smartphones and tablets. These changes have influenced commerce, entertainment, communication, and other areas of human life. New conditions require advanced methods of handling finance.

So how does fintech work? Companies simplify financial transactions for consumers and businesses using artificial intelligence, big data analytics, and blockchain. For example, thanks to e-wallets, you can buy online easily and transfer money quickly. And you do not even need to have a bank account.

What are Fintech Companies?

Fintech companies are organizations that implement digital tools to improve financial services or processes. We can divide them into three main types:

1) Technology businesses that provide IT services in finance;

2) Traditional banking, investment and insurance organizations that improve their work using innovations;

3) High-tech startups create new products that will change the market.

Their goal is to modernize the financial system using innovative solutions. The idea is to develop solutions that would be more convenient and more profitable than existing products.

The most known innovations of fintech companies:

- Management of bank accounts via mobile phones and tablets;

- Contactless payments using devices with built-in NFC chips;

- Electronic wallets and cryptocurrency;

- Online services for getting loans, managing insurance, and trading on exchanges;

- Customer identification systems using biometric data.

Some Examples of Fintech Companies

SoFi

SoFi provides an innovative approach to lending and wealth management. The service allows members to borrow, save, spend, invest, and protect their money.

The four students created the company while they were studying together at Stanford. Now investors estimate the startup at $12.12 billion.

Klarna

Klarna is a Swedish company and one of the largest banks in Europe. It is a shopping application that allows customers to pay after receiving their orders. Thus, they can buy online and not show their credit card details.

Adyen

The company provides businesses with a single platform that accepts point-of-sale (POS), mobile, and e-commerce payments. More than 4500 organizations use the Adyen solution. Their clients are Facebook, Uber, Netflix, Spotify, L’Oréal, eBay, and Microsoft.

Stripe

Stripe is a service that allows businesses to accept online payments in multiple currencies. More than 100,000 companies use this payment system. Stripe’s most famous clients are Facebook, SAP, Kickstarter, Udacity, TED, UNICEF, and many more. The service supports processing payments in more than 135 currencies.

Robinhood

Robinhood is a mobile application that helps people invest in public companies and exchange-traded funds without commission. Robinhood has already attracted millions of non-professional investors to the stock market.

10 Popular Fintech Areas

Personal finance

Many fintech applications allow users to manage their finances and keep track of expenses, income, and savings, for example, Mint, YNAB, Spendee. Any user can easily plan their budget and control where they spend money. Most applications have charts, graphs, and tables, which help to get statistics by day and month.

Payments and transfers

Fintech made it easier to pay online. Before, e-commerce had to conclude agreements with banks. Now they use financial services that help to accept and transfer payments in different currencies, for example, Stripe, QIWI, PayPal.

International transfers were difficult and took several days. Thanks to the development of payment systems, people can send large sums of money. And they can often do it in several minutes.

Insurance

Big data analysis and artificial intelligence technologies help to assess risks and choose the right insurance package. The user can conclude a contract online on the website.

Startups are using technology to improve outdated insurance systems.

For example, telematics helps reduce the cost of insurance policies. How does it work?

Telematics is a special device that you connect to your car. It collects real-time statistics on vehicle handling and driving using GPS and built-in sensors. The insurance company analyzes the way you drive and determines the degree of an accident risk. It means that the cost of services depends on what kind of driver you are. Metromile is a startup that uses telematics for car insurance.

Lending

There are fintech companies that allow you to get a loan without engaging a bank. In this case, investors provide funds to borrowers. The platform acts as a facilitator between them, which automatically checks the creditworthiness of the person who is asking for credit.

There are two types of such lending:

- P2P (person-to-person) when individuals ask for a loan.

- P2B (person-to-business) when a business wants to get a credit.

Borrowers prefer this type of lending because there are fewer requirements and lower rates than a bank has. Examples of such services are Zopa.com, Prosper, LendingClub, and others.

Crowdfunding

Thanks to fintech development, startups and individuals can get collective funding from a group of people. Crowdfunding platforms help founders raise the necessary funds to develop their ideas. Investors can support the projects and receive in return the first products of the company, either a part of the profit, or the full amount, or donate for free.

They also allow people to raise money for charitable, environmental, creative organizations, gathering people around the world for a common goal. Kickstarter and Indiegogo are the most popular platforms for such funding.

Investment platforms

Companies create special financial services for investors, where robotic consultants help them to buy stocks, bonds, funds. They ask the necessary questions to evaluate information about a potential investor to determine investment goals and where they should invest money.

Robots are created primarily for non-professional private investors who make long-term investments. Their services are cheaper than bank consultants.

Betterment Holdings Inc was one of the first to offer the assistance of digital advisors for investment management. Other most popular services that provide e-assistant support in this area are Wealthfront, Vanguard Personal Advisor Services, and Schwab.

Security

Banks and many companies collect a lot of personal data from users. The financial technology services allow us to process them quickly and store them safely. They constantly need to look for new solutions to protect customers from hacker attacks.

Commerce

Store management requires financial technology, especially if you want to grow your business online. Many entrepreneurs have had to close their companies because they haven’t changed their habits in the pandemic conditions. You should apply innovative solutions to implement new retail market trends that increase sales. For example, some social networks and messengers allow you to create online shopping services and make purchasing easier for users.

You can also use fintech in offline commerce. For example, the AmazonGo chain of stores allows shoppers to buy goods without cashiers and sellers. You take the products you want and leave. You do not have to stand in lines and waste time paying. Amazon withdraws money automatically from your account. The company has successfully implemented artificial intelligence technologies, motion sensors, cameras, and smart scales to completely automate the shopping process for customers. And this is just one example of the fintech use case in commerce.

RegTech

Regulatory technologies help companies and banks to automatically adapt their business to changes in legislation and market conditions. When regulators tightened requirements for the financial sector after the 2008 crisis, innovation became a necessity. According to the analytical company Boston Consulting Group, since 2008, the world’s largest banks have spent more than $300 billion on fines, and this amount is constantly increasing. Fintech solutions allow you to automate processes, reduce costs and improve the efficiency of work systems.

Some RegTech companies create platforms that verify the authenticity of identity documents. They help you to check selfie photos with passport data. NEX Regulatory Reporting technology allows you to prepare reports in accordance with the requirements of regulators in Europe, USA, Australia and Singapore.

Banking services and support

Banks develop mobile applications that help users manage their finances and pay for purchases online. Technologies allow to support clients remotely and automate data handling processes.

Neobanks are fintech companies that provide their services and interact with clients online. The main difference from classic banks is the absence of physical offices. Therefore, they can offer better percentage rates and tariffs because they do not need to have a large staff or pay rent. Some well-known neobanks are Monzo, Chime, Bnext.

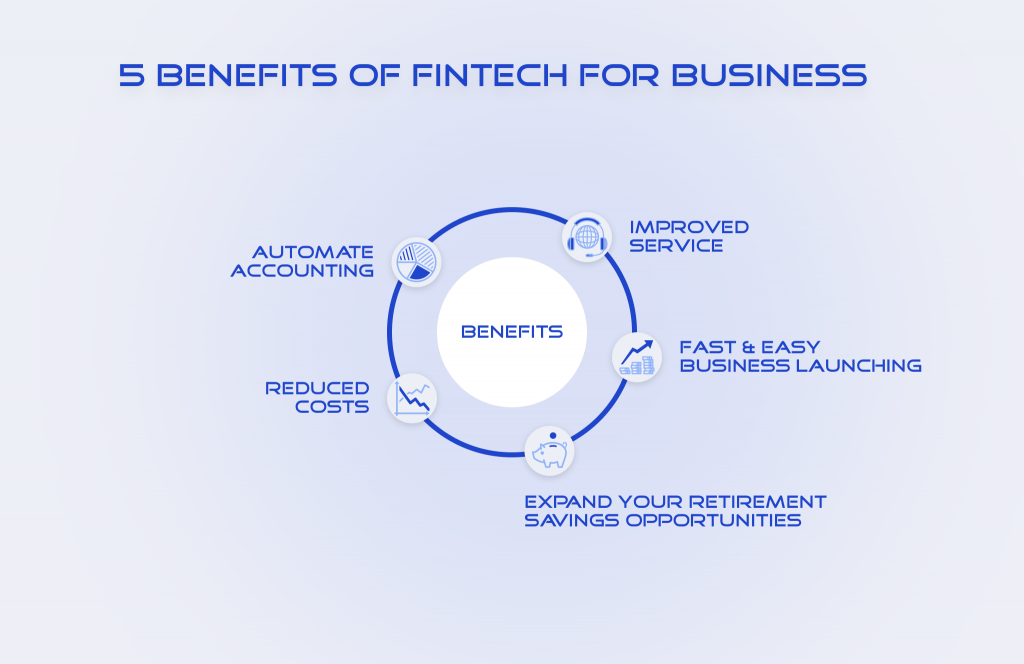

5 Benefits of Fintech for Business

Automate accounting

How much time do you or your employees spend on operational tasks? The success of a company’s stable growth depends on cash flow control and documentation keeping. When you have a clear vision of your expenses, income, and savings, you understand where and how much you can invest.

Financial technology companies offer a variety of applications that automate the management of accounts, wages, costs, and can predict cash flows.

Reduce costs

Technology helps automate data processing and reduce employee costs. Before, you had to hire experienced specialists to collect and organize financial reports and customer information. Now you can accomplish these tasks using fintech innovations.

Improve service

Fintech allows online stores and companies to use convenient payment systems and provide remote services. Optimize any interaction with your customers if you want them to be satisfied and come back to you for repeat purchases.

Using artificial intelligence technology, you can more effectively analyze user behavior and information about them so that later create more personalized products and services.

Launch a business faster and easier

Fintech lending helps companies get loans avoiding bureaucracy. Previously, you had to collect a lot of documents, prepare a business plan, financial reports, and forecasts, and then wait a long time for an answer. Now you can visualize the company’s cash flow to obtain a loan.

If you want to get an investment but do not want to share the company with shareholders, you can use crowdfunding platforms and raise money with group funding. Such sites help you not only to attract investors but also to find your target audience. It means that you can know their opinion about your products or services and optimize them during the process.

Expand your retirement savings opportunities

Fintech companies can reduce the cost of retirement plans and simplify their administration. For example, Ubiquity Retirement helps small companies and startups provide their employees with different retirement savings options. They offer a fixed payment for their services and favorable conditions for entrepreneurs.

Conclusion

So why is fintech important? No business can grow and develop steadily in the conditions of massive digitalization and pandemic if it always uses outdated methods and systems. Do you want to automate the processes in your company and remain competitive in the market? Then you should consider innovating.

Online and offline stores have to process and analyze a huge amount of data about their customers’ purchases to personalize offers and influence sales. It means they have to face machine learning and artificial intelligence technologies. Otherwise, they need to invest more money in collecting and processing data.